- First point, this is posted as a result to some offline email exchange debates I had with an anonymous somewhat newbie trader buddy I know through some forums.

- His obsession with funding huge amounts,leveraging to the hilt and wildly punting trades without any technical or fundamentally sound reason is why I just said, screw the chart(even though this has been already charted on this blog) it's about numbers, results and risk management.

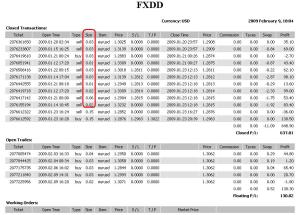

- This is a live statement, not a churned, curved fitted after the fact , hard right edge demo.

- Highlighted are the stats that matter most to me. The position size averages about 4 micro lots, yes there's 2 trades that are 1.5 mini in size, but you can see, there are trades as small as 1 teeny weeny micro that made hundreds of pips, so more bang for your micro bucks.

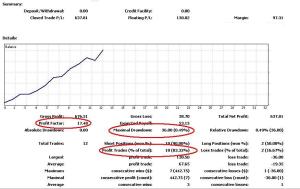

- The statments stats are typical of other statments I can pull out the past 6 months, the most important stats to me I circled and is what I look for in a nice robust methodology.

Back to the important points:

- You'll notice that the timeframe of the trades is about a week or so, not a whole lot of trades. You certainly have to pick your points, you don't get more money for trading more, more than likely you'll get clipped especially with high volitility. This particular week wasn't real high vol, but it wasn't a cakewalk either.

- The profit factor is usually what my eyes see first, a 3 or 4 is considered great by most people, I'd be happy with 4 and there is no doubht over time a 4 factor will grow your account, a 17, well who wouldn't love that, but realistically, to maintain this 17 factor ain't gonna happen over time, so take a 3 or 4 and be content, and run with it.

- Drawdown, to me under 10% is pretty good, I've averaged less than 5%, but again, I don't day trade and am very selective if I choose a breakout.

- Notice most trades are shorts, well that was the trend.There were a few countertrend longs that made a pretty profit.

- Notice that the Open Trades are Long Countertrend trades. Sometimes you have to take these risks, I personally don't like countertrend. When you're trading against the trend, you have to really have to be on top and be able to bail or scale down, even if you're too early. Bottom line, pile on the position when the trend reveals itself, in a countertrend, you'll know whether you're right in a very short period of time. If you're wrong, it's like jumping off of a train, the momentum will build and you'll get hurt even if u jump off.

- I trade CAD, AUD sometimes, but mainly stay with EUR, GBP and JPY. CAD could have some huge moves sometimes, but the trend could flip on a dime and drive you nuts. To me all pairs do not behave the same, I believe this, so trend is what you have to see in any instrument.

- Finally, consistancy. Being 50% correct is just not good enough for me, even with a pretty good profit factor, being only right 1/2 the time would just affect the mental aspect of my trading, I'll flip a coin if I want 50/50 odds. I want 70% or at least strive for that, and that's been about my average through many statements Ive cycled through, if i approach 50% then I knowI'm out of wack, whether the account reads profit or not, sometimes I don't even look at the profit, I look at how limited I made the risk, and how I rode the momentum when it revealed itself and confirmed the trend.

- 100% return account I thought was impossible to achieve, especially a small account, it's possible if you don't give back profits, I've personally seen 300%, but like many good traders you'll hear, the more you make, you still need to be carefull of leverage, notice the margin on these trades, not particularly high.

- Ok, that ends my debate rant, so remember to always ask who you debate with to show you the results, not the demos, the predictions and assumptions.

- Finally, small ain't always bad, if you can grow a micro, you can grow a mini, and a standard, of course the stress level will be different, so trade according to your blood pressure. If your broker snarls at you for converting your mini to micro, please don't yack at me, haha. Good Luck.